Table of Contents

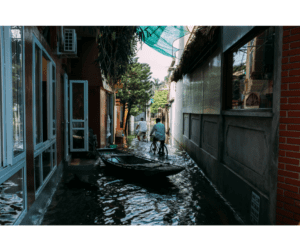

ToggleOwning a condominium offers many advantages, from shared amenities to a sense of community. However, when it comes to protecting your investment, particularly in the face of natural disasters like floods, condo owners need to be well-informed about their insurance options. In this article, we’ll explore the importance of flood insurance for a condo, the specific challenges condo owners may face, and how obtaining the right coverage can make all the difference in safeguarding your property.

The Unique Challenge for Condo Owners

Unlike single-family homes, condominiums are part of a larger complex with shared spaces and interconnected systems. This interconnectedness can pose a unique challenge when it comes to protecting individual units from flooding. While homeowners’ associations typically carry insurance for common areas, such as the lobby or parking garage, coverage for individual units may be limited. This leaves condo owners vulnerable to potential damage caused by flooding, which is not always covered by standard homeowners’ insurance policies.

Understanding Flood Insurance for a Condo

Understanding Flood Insurance for a Condo

Flood insurance is a specialized type of coverage designed to protect property owners from the financial devastation caused by flooding. It’s important to note that standard homeowners’ insurance policies typically exclude coverage for flood-related damage. As a result, condo owners must seek out separate flood insurance policies to ensure comprehensive protection against this specific risk. Purchasing flood insurance for a condo is a must to protect a unit and the belongings it from a flood.

The National Flood Insurance Program (NFIP)

In the United States, the primary source of flood insurance is the National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA). The NFIP aims to reduce the impact of flooding by providing affordable insurance to property owners, promoting sound floodplain management, and encouraging communities to adopt and enforce floodplain regulations.

For condo owners, participating in the NFIP is crucial for obtaining flood insurance for a condo. NFIP policies cover both the building structure and its contents, providing a comprehensive solution for protecting your investment. Condo owners can purchase separate policies for their individual units, ensuring that both the structure and personal belongings are safeguarded in the event of a flood.

Private Flood Insurance

A great alternative to the NFIP is private flood insurance for a condo. Unlike the National Flood Insurance Program (NFIP), private flood insurance is offered by individual insurers and may offer more flexibility in terms of coverage options and premiums. Condo owners can tailor policies to their specific needs, covering both the structure and contents of their units. Often private flood insurers will offer better rates than what the NFIP program offers along with additional coverage options.

Factors to Consider When Purchasing Flood Insurance for a Condo

- Elevation and Flood Zone: Condos located in flood-prone areas may face higher premiums. Understanding the elevation of your condo and its designated flood zone can help you assess the level of risk and determine the appropriate coverage.

- Contents Coverage: In addition to covering the structure itself, condo owners should consider purchasing contents coverage to protect personal belongings within their units. This can include furniture, electronics, and other valuable items that may be damaged in a flood.

- Community Involvement: Condo owners should work closely with their homeowners’ association to understand the existing flood mitigation measures in place and to encourage the community’s active participation in FEMA’s Community Rating System (CRS). Communities that participate in the CRS may be eligible for reduced flood insurance premiums.

- Policy Limits and Deductibles: Carefully review the policy limits and deductibles when selecting flood insurance. Understand the maximum coverage available and choose a deductible that aligns with your financial comfort level.

Conclusion

Flood insurance for condos is a critical component of protecting your investment and ensuring financial security in the face of unforeseen natural disasters. As a condo owner, it’s essential to be proactive in understanding the unique challenges posed by flooding and to take the necessary steps to secure comprehensive coverage. By participating in the National Flood Insurance Program or a private flood insurance insurer and working collaboratively with your homeowners’ association, you can navigate the waters of flood insurance with confidence, safeguarding both your property and your peace of mind. Remember, when it comes to flood protection, knowledge is your most valuable asset.